Enter the address of the property with a unit number of “residential” or “commercial” and click the find BBL button in the property information screen. Enter a Tax Exemption Affidavit for a document by completing the Fees & Taxes and Supporting Documents tabs. Select the exemption type being submitted using the Fees & Taxes tab. Check off the appropriate affidavit being submitted and enter the page count of the affidavit.

The Members Portal contains information about past, current and future ACRIS projects. Project information may include the Project Initiation Document , detailed business requirements, use cases and user stories, domain models and other artefacts such as XSDs and API specifications. The Airports Council International Airport Health Measures Portal was developed by ACI as service to the industry and the traveling public in response to the COVID-19 pandemic.

Further access to ACRIS

Each document in a transaction requires a Cover Page. The fees and taxes are calculated individually for each document within the transaction; however, charges are combined into one total payment for the transaction. The Office of the City Register records and maintains New York City Real Property and certain Personal Property transfers such as mortgage documents for property in all boroughs except for Staten Island.

I have a Condo property, but I can’t get FIND in the Property Information screen to return the unit number. You have not completed all required tabs and fields. In order to make any changes on the tax form, you will need to release the data from the Cover Page. Checks for Recording Fees, Filing Fees, Mortgage Tax, NYC Real Property Transfer Tax and NYS Real Estate Transfer tax should be made payable to NYC Department of Finance.

ACRIS SOFTWARE

If you have already prepaid both the RPTT and TP-584 you do not need to create new E-Tax forms. When you create your Cover Page, select Pre-paid at City Register from the pull-down menu in the RPTT Fees & Taxes tab. Select either Pre-paid at City Register or Pre-paid elsewhere from the pull-down menu in the RETT Fees & Taxes tab.

Yes, there is a separate $5 fee for submitting the Recording and Endorsement and Continuation Cover Page. There is no additional charge for other cover pages a detailed description of City Register taxes and fees can be found on the ACRIS home page under Fees and Requirements tab. As part of the ACRIS process, recording fees are calculated and a total fee page generated at the end of the cover page session. A Document ID represents a single document to be recorded . A transaction may consist of one or more documents that share a Transaction Number. For example, a deed and a mortgage might be submitted together in a single transaction.

Questions about using Cover Page with E-Tax

Within a transaction, names and addresses can be copied from a prior document to the current document by using the copy buttons on the Document and Party Tabs. If the user ID and/or password have been forgotten, type in user ID and hit forgot password. Answer security questions or have a link sent to your e-mail address and follow the instruction from the email to rest the user ID/password. Alternatively, a new user ID and password can be created. The Department of Finance assumes no liability for failure to provide the requested notice of recorded documents with respect to property for which you are registering to receive notification. Historical index data is also available for download by special request to the City Register.

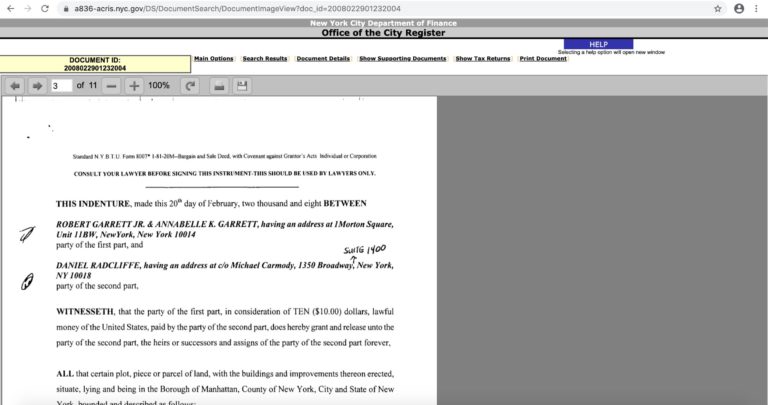

Property documents are recorded and maintained on the Automated City Register Information System . ACRIS provides online access to property documents and data dating back to 1966. For documents before 1966, please visit the City Register’s office in each of the four boroughs to view them on microfiche and microfilm. For additional details on how to claim a new Real Property Transfer Tax (“RPTT”) exemption for transfers of real property subject to certain affordable housing restrictions, click here.

Go to the Alpha Schedule that will not check off and make sure that you did not enter any information; click the” Clear” button at the bottom of the alpha schedule. When you look through your tax forms, you should see a rider listing the additional entries that did not display on the main pages of the tax forms. These riders should be submitted along with your tax forms to the City Register. Go back into the tax form by clicking the “Edit” button in the tax transaction screen. The Transaction screen is displayed when the user selects “Retrieve Cover Page Transaction.” The user must enter a Transaction number and click the” Search” button to retrieve the data. If the user does not have a transaction number, they can click on “Show Unrecorded Transaction” at the bottom of the screen.

The user may click on the “show unrecorded transaction option.” If the transaction was purged, users will need to create new tax forms and cover pages. Incomplete cover page transactions are purged from the system every 30 days. If the user is at a City Register public access terminal , all pages will be printed to a printer located in the Public Access area. In this case, the customer will have to go to the printer to pick up the printouts. If the user is printing elsewhere, the pages will be printed to the user’s default printer.

A user can only make changes to a cover page, if the transaction has not been submitted for recording. The Return To entity is the individual or business organization to witch the City Register will return the recorded document. Start by clicking on New Cover page from ACRIS main menu, and then select your document class and type from the drop-down list. If you try to enter it more than once, the “not unique enough” message pops up. The e-mail address could have been previously used or is not a valid e-mail address.

Cover pages can be printed at any time after they have been successfully completed and up until the document have been physically received by the City Register and completed the Intake process. A user can also print cover pages that have been rejected by the City Register. Cover Pages cannot be printed for documents electronically submitted. In addition to property owners and their agents , the managing agent, the property owner’s attorney, the lienor, or executors/administrators of the estate of the owner or lienor of the property may register under this program.

With over 25+ years combined experience most of our developers have accrued at least 5 years of experience having grown up learning latest technology fundamentals. We implement innovative custom software solutions to solve business issues and improve how your business operates. We build bespoke software and applications for small and large organisations to help them advance in their operation. Improve operational performance such as aircraft turnaround times by sharing timely, consistent and reliable information with all parties involved. Improve situational awareness with easy access to timely, relevant and reliable information.

The definition and implementation of standardized business processes and interoperable IT solutions is a vital issue for the global aviation industry, especially as a way to improve efficiency and to increase revenues. For additional information on the Real Property Transfer Tax click here. Transfer to the owner must be filed in the second cover page. The Document Date entered should be the same as the Cover Page preparation date, or within six months of the initial UCC filing's expiration date.

The City Register reserves the right to require payment by certified check. The documents can be submitted to any of the City Register’s locations. The address of City Register offices can be found on the Department of Finance website.

No comments:

Post a Comment